Softening Challenge Period and Penalites

The aim of the challenge period is to evaluate the procured signals of miners to ensure they are consistently profitable. To achieve this, we examine the number of closed positions, total returns, the returns ratio, and the unrealized returns ratio.

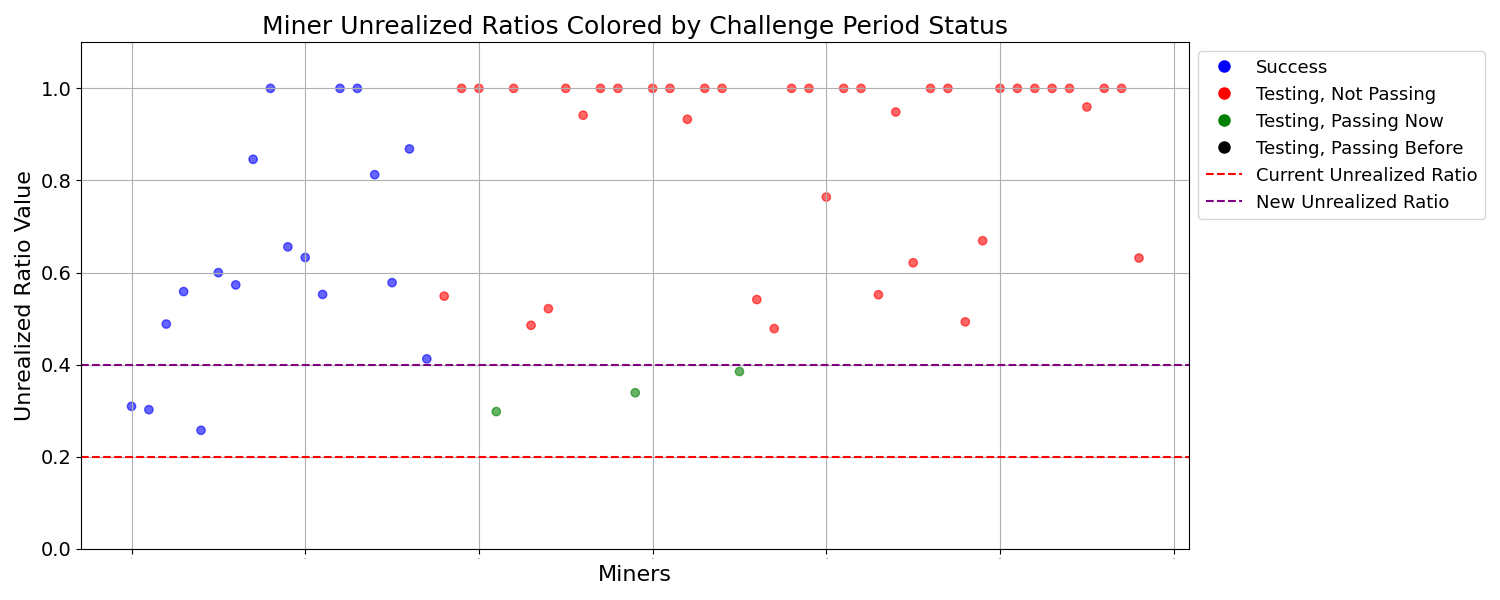

- The unrealized returns ratio examines 24-hour intervals and ensures daily returns don’t surpass 20% of the total returns. The daily and biweekly penalties are related to this challenge period criterion.

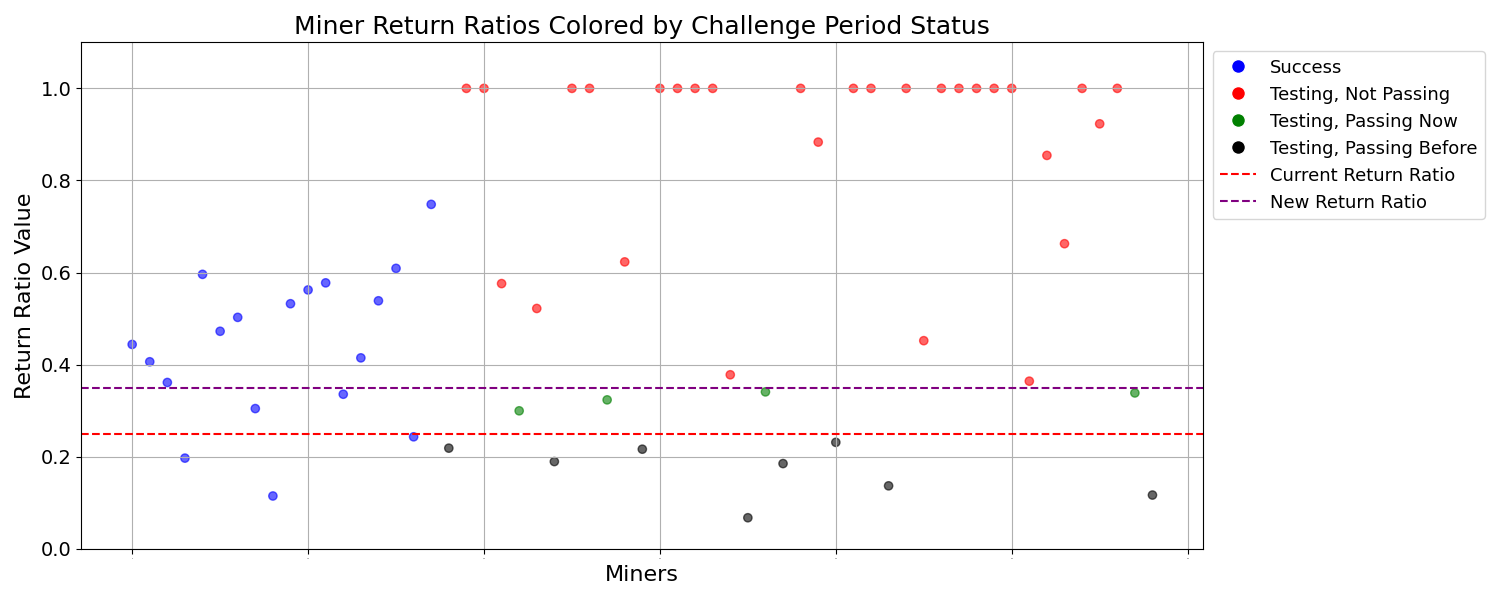

- The returns ratio guarantees that no single position’s returns can account for more than 25% of the miner’s overall returns.

The unrealized returns ratio is meant to ensure time consistency, while the returns ratio is meant to ensure positional consistency. The incentive mechanism must also be in alignment with challenge period constraints.

Problem Statement

The following issues exist with challenge period:

- The challenge period’s stringent criteria could be excluding promising strategies that fail to satisfy its current standards.

- While the challenge period necessitates miners to demonstrate consistent profitability via frequent trades, it must also allow for strategies that capitalize on market volatility.

- Challenge period criteria should align with the network’s incentive mechanism, ensuring that miners who successfully complete the challenge period are well-positioned for continued success.

Proposed Adjustments

We want valuable and effective strategies to always be incentivized. We propose the following changes:

- The unrealized returns ratio threshold will increase from 20% to 40%

- The returns ratio threshold will increase from 25% to 35%

- Increase daily penalty sigmoid shift value from 0.35 to 0.45

- Increase biweekly penalty sigmoid shift value from 0.5 to 0.55

Increasing the sigmoid shift values will decrease the penalty score for daily and biweekly penalities which aligns the incentive mechanism with the adjustment to the unrealized returns ratio threshold.

Our analysis of the top 5 miners indicates average unrealized returns and returns ratios of 0.38 and 0.4, respectively, both with a standard deviation around 0.1. Aligning the thresholds closer to these averages will not only improve the compatibility between the challenge period and the incentive mechanism but also foster a wider range of competitive strategies on the network. This will improve the balance between supporting consistent strategies and strategies that take advantage of periods of market volatility.

These changes will not be retroactive and will only affect current and future challenge period participants.

Effects of the Adjustments to Challenge Period

Note that the miners that passed challenge period (blue dots) are sorted left to right in descending order based on the percentage of weight received by the network.

Timeline

Proposal Delivery: Oct 1, 2024

PR: Oct 1, 2024

Integration: Oct 4, 2024